VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND

VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND II

VIRTUS ALLIANZGI CONVERTIBLE & INCOME 2024 TARGET TERM FUND

VIRTUS ALLIANZGI DIVERSIFIED INCOME & CONVERTIBLE FUND

VIRTUS ALLIANZGI EQUITY & CONVERTIBLE INCOME FUND

ALLIANZGI NFJ

VIRTUS DIVIDEND, INTEREST & PREMIUM STRATEGY FUND

1633 Broadway

New York, New York 10019

Greenfield, MA 01301-9668

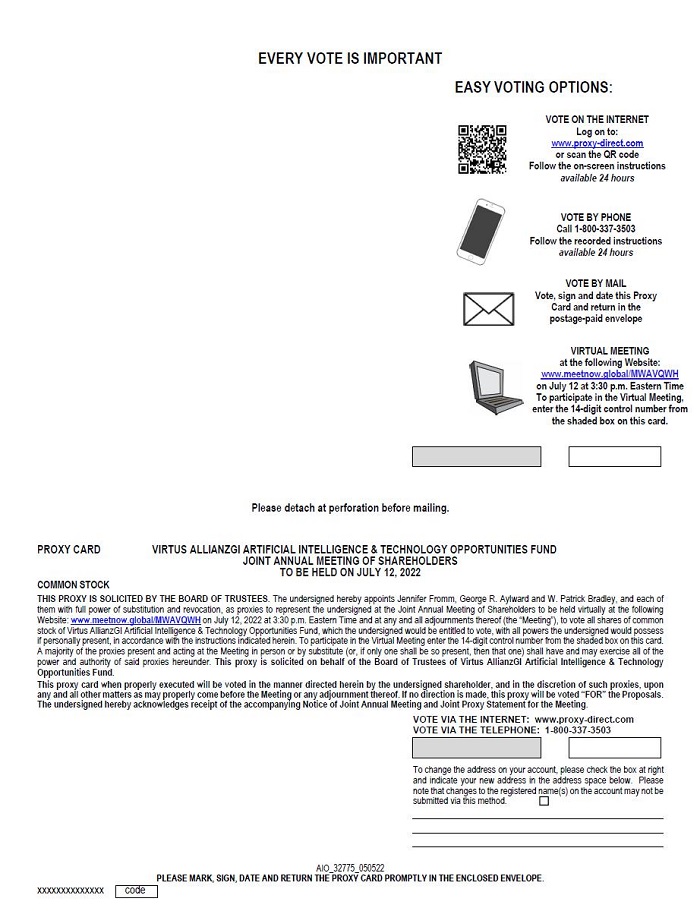

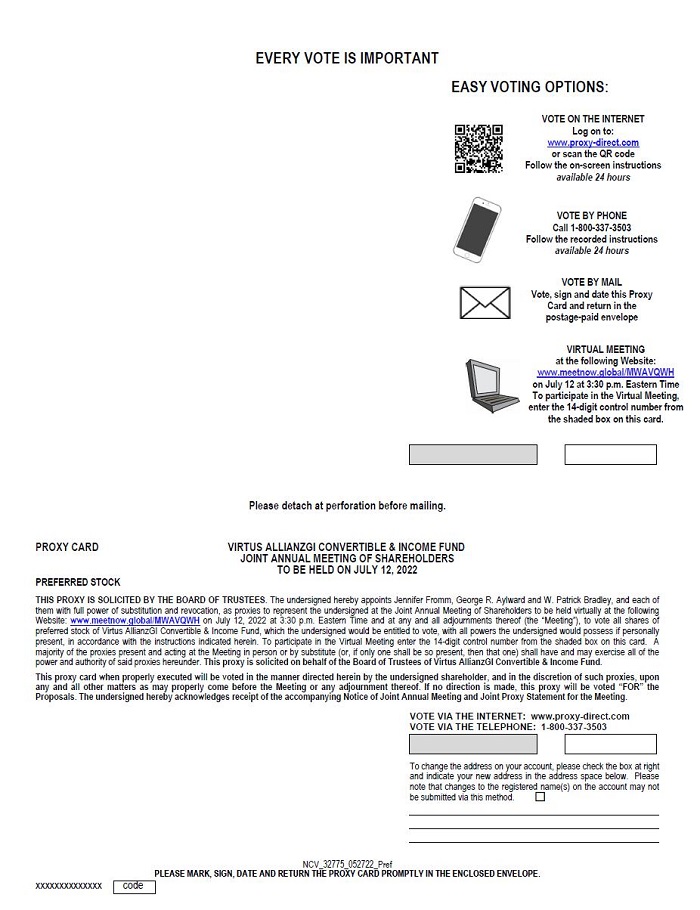

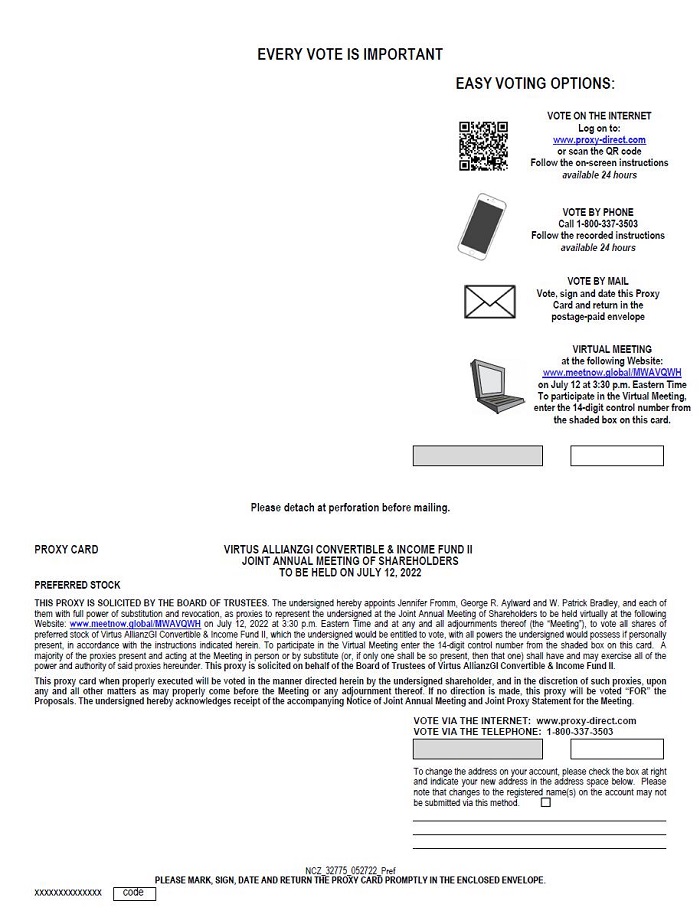

Notice is hereby given, that jointthe Joint Annual MeetingsMeeting of Shareholders (each, a “Meeting”) of the Funds (the “Annual Meeting”) will be held at the offices of Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Manager”), at 1633 Broadway, between West 50th and West 51st Streets, 42nd Floor, New York, New York 10019, on Thursday, July 12, 2018, with2022 at 3:30 p.m. Eastern Time. In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, the Annual Meeting towill be held in a virtual meeting format only and will be conducted exclusively by webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting:

The Board of Trusteespurposes:

|

New York, New York

June 4, 2018

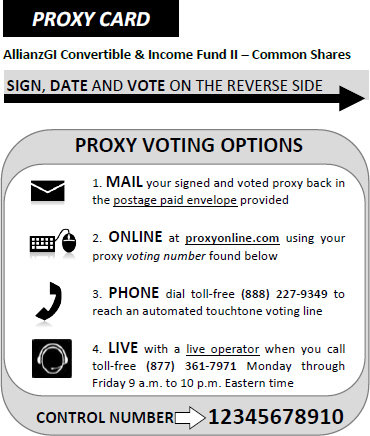

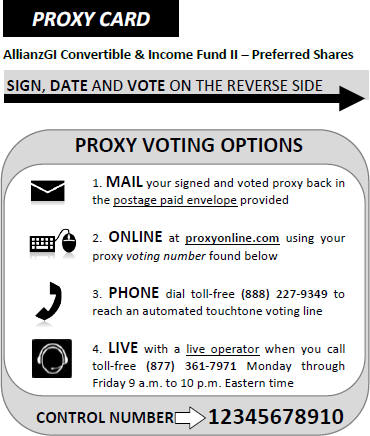

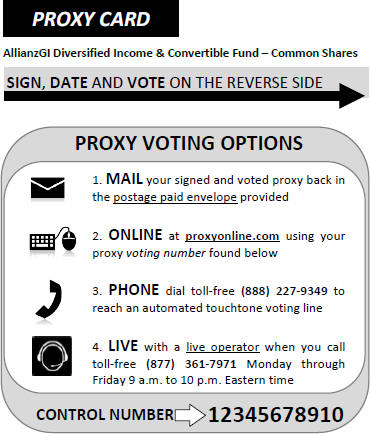

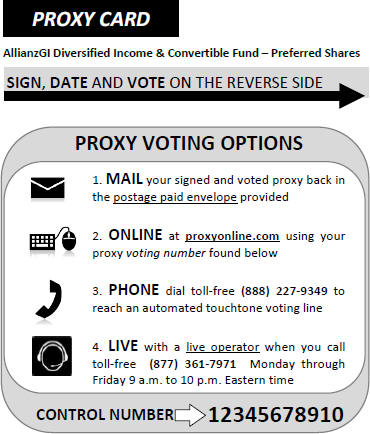

It is important that your shares be represented at the applicable Meeting in person or by proxy, no matter how many shares you own. If you do not expect to attend the applicable Meeting, please complete, date, sign and return the applicable enclosed proxy or proxies in the accompanyingpostage-paid envelope which requires no postage if mailedprovided, or vote via the Internet or telephone, so you will be represented at the Annual Meeting.

Secretary

Virtus AllianzGI Convertible & Income Fund

Virtus AllianzGI Convertible & Income Fund II

| | | IMPORTANT: | | |

| | | Shareholders are cordially invited to attend the Annual Meeting (virtually). In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, even if you plan to attend the Annual Meeting (virtually). Please refer to the website and telephone number indicated on your proxy card for instructions on how to cast your vote. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote by mail, please complete, sign, date, and mail the enclosed proxy card. No postage is required if you use the accompanying envelope to mail the proxy card in the United States. The proxy is revocable and will not affect your right to vote in person (virtually) if you attend the Annual Meeting and elect to vote in person (virtually). | | |

| | | | Registrations | | | Valid Signature | |

| Corporate Accounts | | | (1) ABC Corp | | | (1) ABC Corp | |

| | (2) ABC Corp | | | (2) John Doe, Treasurer | | ||

| | (3) ABC Corp. c/o John Doe, Treasurer | | | (3) John Doe | | ||

| | (4) ABC Corp. Profit Sharing Plan | | | (4) John Doe, Trustee | | ||

| Partnership Accounts | | | (1) The XYZ partnership | | | (1) Jane B. Smith, Partner | |

| | (2) Smith and Jones, limited partnership | | | (2) Jane B. Smith, General Partner | | ||

| Trust Accounts | | | (1) ABC Trust | | | (1) John Doe, Trustee | |

| | (2) Jane B. Doe, Trustee u/t/d 12/28/78 | | | (2) Jane B. Doe | | ||

| Custodial or Estate Accounts | | | (1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | | | (1) John B. Smith | |

| | (2) Estate of John B. Smith | | | (2) John B. Smith, Jr., Executor | |

participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it or you may call 1-888-724-2416 or 1-781-575-2748.

ALLIANZGI CONVERTIBLE & INCOME FUND (“NCV”)

ALLIANZGI CONVERTIBLE & INCOME FUND II (“NCZ”)

ALLIANZGI CONVERTIBLE & INCOME 2024 TARGET TERM FUND (“CBH”)

ALLIANZGI DIVERSIFIED INCOME & CONVERTIBLE FUND (“ACV”)

ALLIANZGI EQUITY & CONVERTIBLE INCOME FUND (“NIE”)

ALLIANZGI NFJ DIVIDEND, INTEREST & PREMIUM STRATEGY FUND (“NFJ”)

1633 Broadway

New York, New York 10019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

STATEMENT

FOR

JOINT ANNUAL

TO BE HELD ON

JULY 12,

This Proxy Statement, and the Annual Reports to Shareholders for the fiscal years ended January 31, 2018 for ACV, NIE and NFJ and February 28, 2018 for NCV, NCZ and CBH, are also available at http://us.allianzgi.com/closedendfunds.

PROXY STATEMENT

June 4, 2018

FOR THE JOINT ANNUAL MEETINGS OF SHAREHOLDERS

TO BE HELD ON JULY 12, 2018

INTRODUCTION

2022

1

The Notice of joint Annual Meetings of Shareholders (the “Notice”), this Proxy Statement and the enclosed proxy cardscard are first being sentmailed to Shareholdersshareholders on or about June 4, 2018.

Each7, 2022.

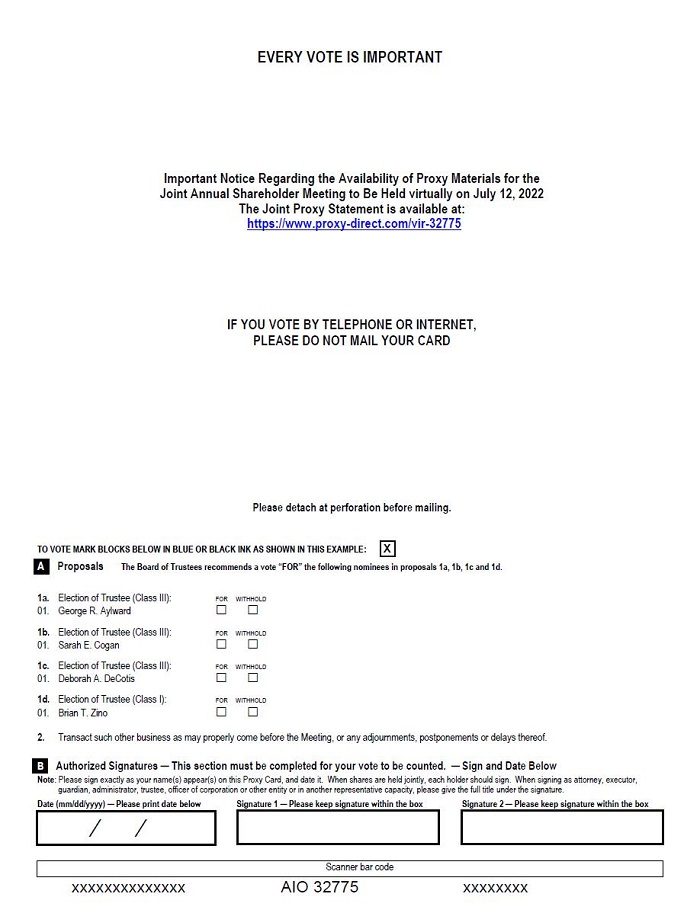

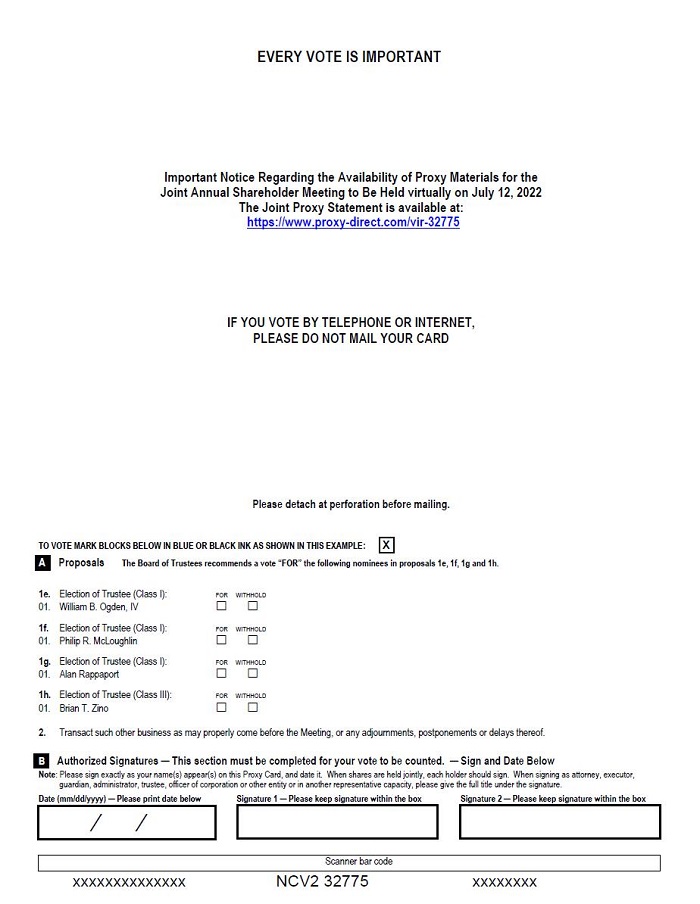

| Proposal | | | Shareholders Entitled to Vote | | |||

| 1a | | | Elect George R. Aylward as a Class III trustee of AIO | | | AIO shareholders | |

| 1b | | | Elect Sarah E. Cogan as a Class III trustee of AIO | | | AIO shareholders | |

| 1c | | | Elect Deborah A. DeCotis as a Class III trustee of AIO | | | AIO shareholders | |

| 1d | | | Elect Brian T. Zino as a Class I trustee of AIO | | | AIO shareholders | |

| 1e | | | Elect William B. Ogden, IV as a Class I trustee of NCV | | | NCV shareholders | |

| 1f | | | Elect Philip R. McLoughlin as a Class I trustee of NCV | | | NCV shareholders of preferred shares | |

| 1g | | | Elect Alan Rappaport as a Class I trustee of NCV | | | NCV shareholders | |

| Proposal | | | Shareholders Entitled to Vote | | |||

| 1h | | | Elect Brian T. Zino as a Class III trustee of NCV | | | NCV shareholders | |

| 1i | | | Elect Sarah E. Cogan as a Class I trustee of NCZ | | | NCZ shareholders of preferred shares | |

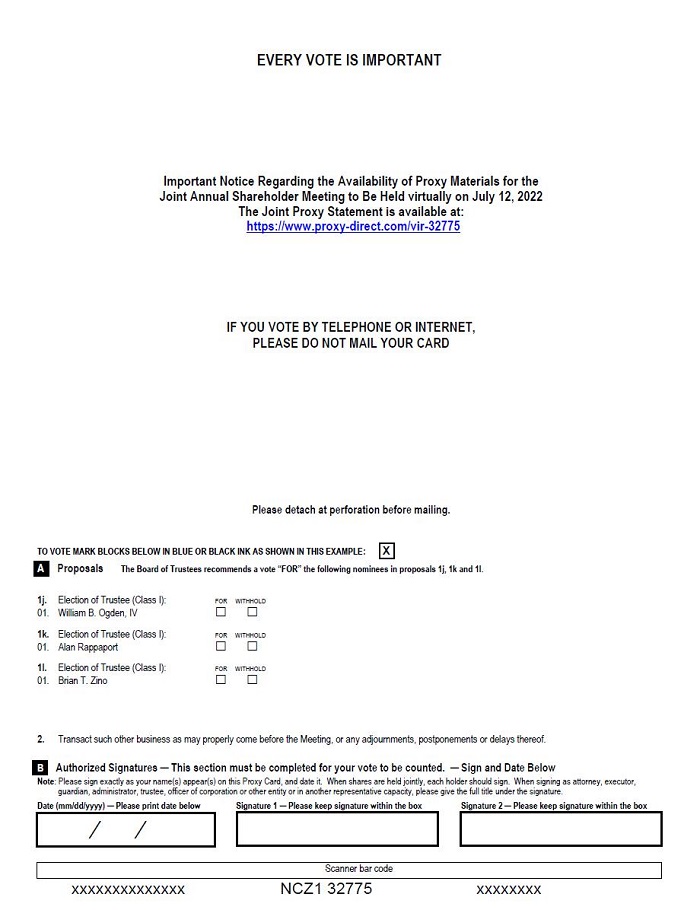

| 1j | | | Elect William B. Ogden, IV as a Class I trustee of NCZ | | | NCZ shareholders | |

| 1k | | | Elect Alan Rappaport as a Class I trustee of NCZ | | | NCZ shareholders | |

| 1l | | | Elect Brian T. Zino as a Class I trustee of NCZ | | | NCZ shareholders | |

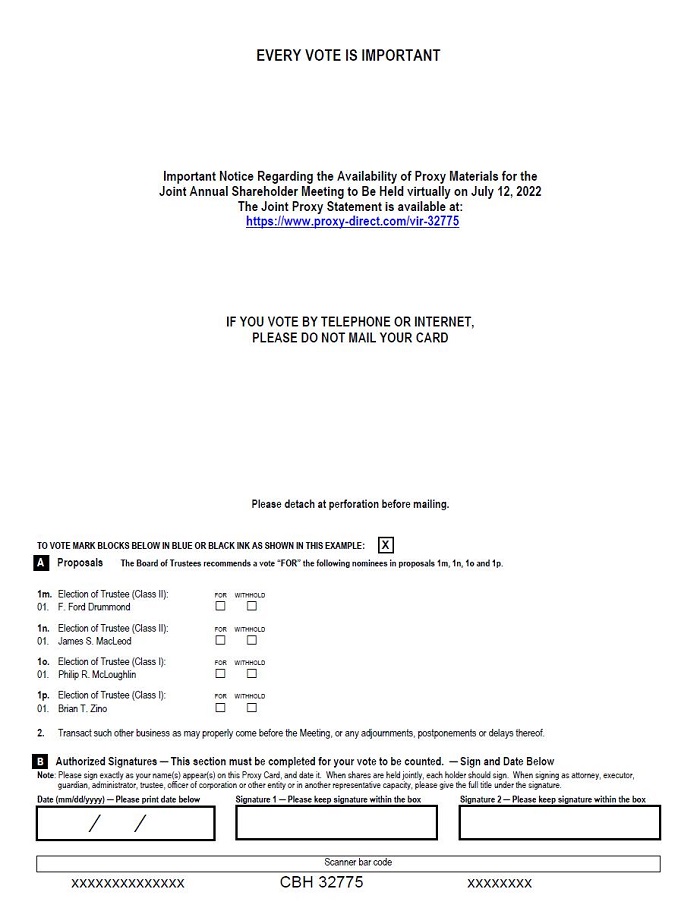

| 1m | | | Elect F. Ford Drummond as a Class II trustee of CBH | | | CBH shareholders | |

| 1n | | | Elect James S. MacLeod as a Class II trustee of CBH | | | CBH shareholders | |

| 1o | | | Elect Philip R. McLoughlin as a Class I trustee of CBH | | | CBH shareholders | |

| 1p | | | Elect Brian T. Zino as a Class I trustee of CBH | | | CBH shareholders | |

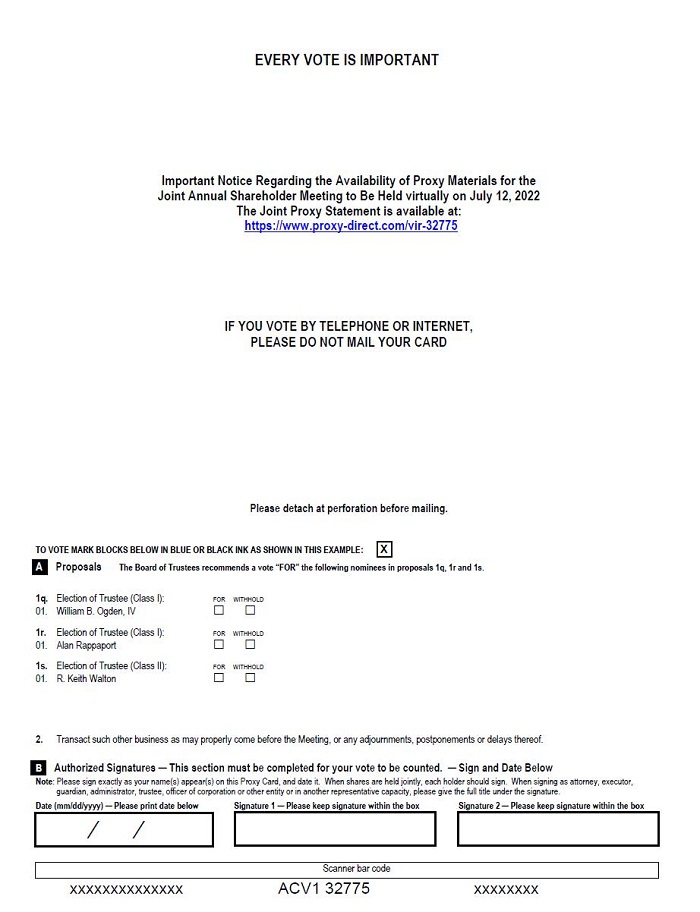

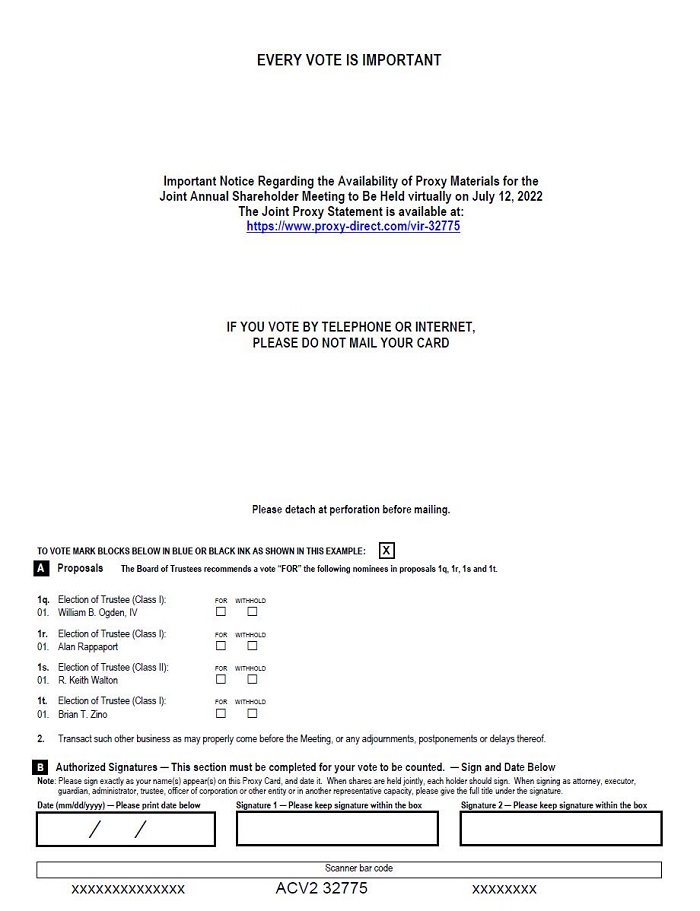

| 1q | | | Elect William B. Ogden, IV as a Class I trustee of ACV | | | ACV shareholders | |

| 1r | | | Elect Alan Rappaport as a Class I trustee of ACV | | | ACV shareholders | |

| 1s | | | Elect R. Keith Walton as a Class II trustee of ACV | | | ACV shareholders | |

| 1t | | | Elect Brian T. Zino as a Class I trustee of ACV | | | ACV shareholders of preferred shares | |

| 1u | | | Elect George R. Aylward as a Class III trustee of NIE | | | NIE shareholders | |

| 1v | | | Elect Sarah E. Cogan as a Class III trustee of NIE | | | NIE shareholders | |

| 1w | | | Elect Deborah A. DeCotis as a Class III trustee of NIE | | | NIE shareholders | |

| 1x | | | Elect Brian T. Zino as a Class I trustee of NIE | | | NIE shareholders | |

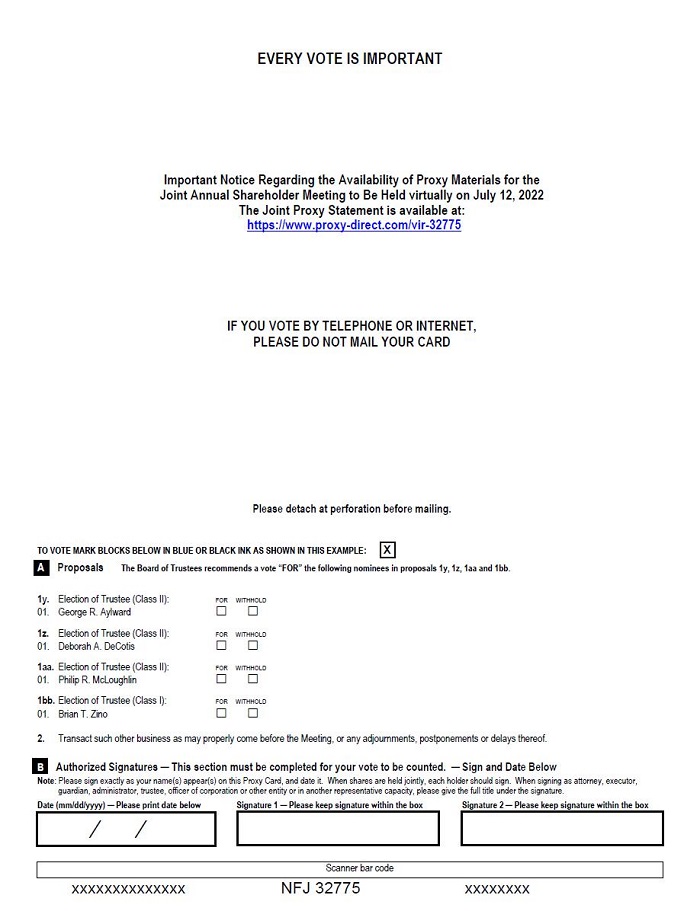

| 1y | | | Elect George R. Aylward as a Class II trustee of NFJ | | | NFJ shareholders | |

| 1z | | | Elect Deborah A. DeCotis as a Class II trustee of NFJ | | | NFJ shareholders | |

| 1aa | | | Elect Philip R. McLoughlin as a Class II trustee of NFJ | | | NFJ shareholders | |

| 1bb | | | Elect Brian T. Zino as a Class I trustee of NFJ | | | NFJ shareholders | |

| 2 | | | Transact such additional business as properly comes before the Meeting | | | AIO, NCV, NCZ, CBH, ACV, NIE and/or NFJ shareholders | |

The Board of each Fund has fixedcheck in. Please follow the close of business on May 17, 2018registration instructions as theoutlined in this proxy statement.

| Outstanding Common Shares | Outstanding Preferred Shares | |||||||

NCV | 88,996,725 | 14,280 | ||||||

NCZ | 75,067,600 | 10,960 | ||||||

ACV | 10,274,970 | 1,200,000 | ||||||

NIE | 27,708,965 | N/A | ||||||

NFJ | 94,801,581 | N/A | ||||||

CBH | 18,257,012 | N/A | ||||||

The classes of Shares listed for each FundTrustees, except as otherwise described in the table above arefollowing paragraph.

At theAnnual Meeting, the election of certain Trustees (the “Preferred Shares Trustees”) of NCV, NCZ and ACV will be voted on exclusively by the applicable Fund’s Preferred Shareholders. For NCV and NCZ, with regard to any matter where holders of Preferred Shares are entitled to vote as a class separate from holders of Common Shares, including the election of Preferred Shares Trustees, each Preferred Share will entitle its holder to one vote for every $25.00 in liquidation preference represented by such Preferred Share (and any fraction of $25.00 shall be entitled to a proportionate fractional vote). For ACV, Preferred Shares will entitle their holders to one vote per share in the election of the Preferred Shares Trustees. On each other proposal to be brought before the Annual Meeting (including the election of the nominees other than the Preferred Shares Trustees by all Shareholders), the Preferred Shareholders if any,of each of NCV, NCZ and ACV will have equal voting rights (

2

one vote per Share) with the applicable Fund’s Common Shareholders and will vote together with Common Shareholders as a single class. As summarizedof the Record Date, NCV and NCZ each had outstanding series of auction rate preferred shares (“Auction Rate Preferred Shares”) with liquidation preference of $25,000 per share and cumulative preferred shares (“Cumulative Preferred Shares”) with liquidation preference of $25.00 per share.

| | | | Outstanding Common Shares | | | Outstanding Preferred Shares | | ||||||

| AIO | | | | | 34,340,972 | | | | | | N/A | | |

| NCV | | | | | 90,373,569 | | | | | | 4,008,931(1) | | |

| NCZ | | | | | 76,115,749 | | | | | | 4,366,501(2) | | |

| CBH | | | | | 18,263,597 | | | | | | N/A | | |

| ACV | | | | | 10,362,954 | | | | | | 1,200,000 | | |

| NIE | | | | | 27,708,965 | | | | | | N/A | | |

| NFJ | | | | | 94,801,581 | | | | | | N/A | | |

NCV:

above are the only classes of Shares currently authorized by that Fund.

JULY 12, 2022:

NCZ:

The Common and Preferred Shareholders of NCZ, voting together as a single class, have the right to vote on there-election of F. Ford Drummond, Hans W. Kertess, James S. MacLeod and A. Douglas Eu, and the election of Erick R. Holt as Trustees of NCZ.

ACV:

The Common and Preferred Shareholders of ACV, voting together as a single class, have the right to vote on the election of Deborah A. DeCotis, Bradford K. Gallagher and Erick R. Holt as Trustees of ACV.

NIE:

The Common Shareholders of NIE, voting as a single class, have the right to vote on there-election of F. Ford Drummond, James A. Jacobson, James S. MacLeod and A. Douglas Eu, and the election of Erick R. Holt as Trustees of NIE.

NFJ:

The Common Shareholders of NFJ, voting as a single class, have the right to vote on there-election of Hans W. Kertess, James S. MacLeod, William B. Ogden, IV and A. Douglas Eu, and the election of Erick R. Holt as Trustees of NFJ.

CBH:

The Common Shareholders of CBH, voting as a single class, have the right to vote on the election of Hans W. Kertess, William B. Ogden, IV, Alan Rappaport, Davey S. Scoon and Erick R. Holt as Trustees of CBH.

Summary

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

3

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

4

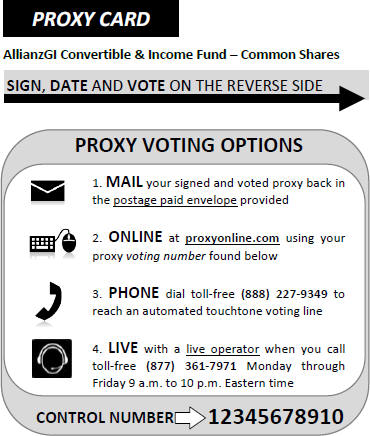

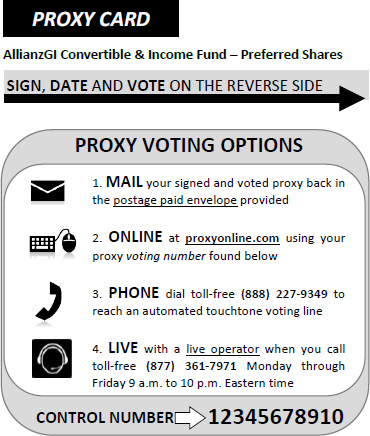

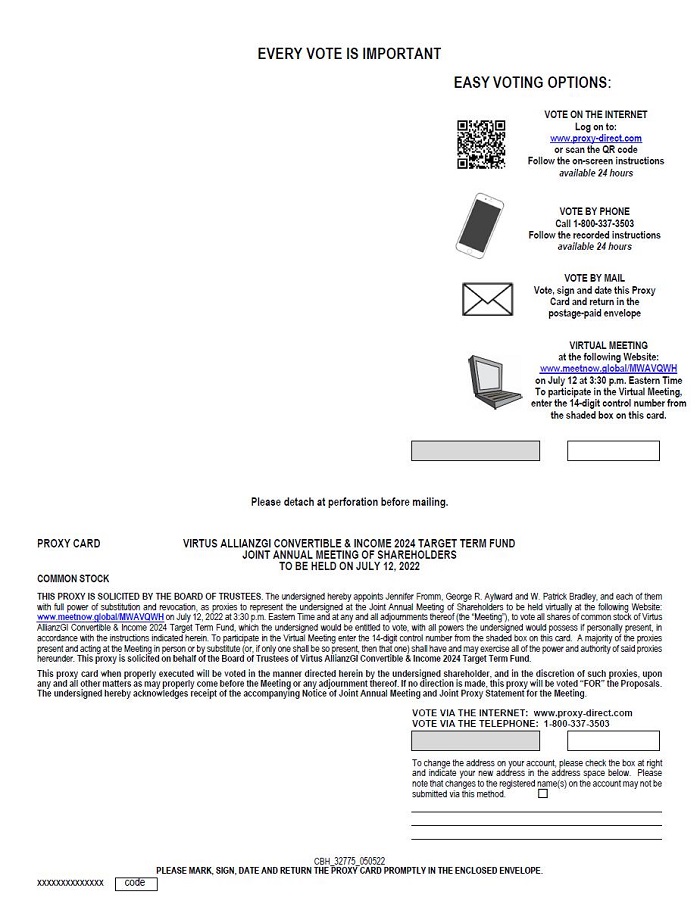

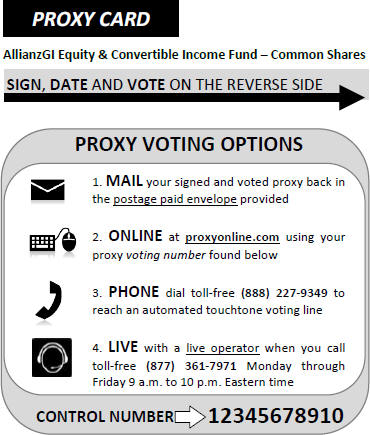

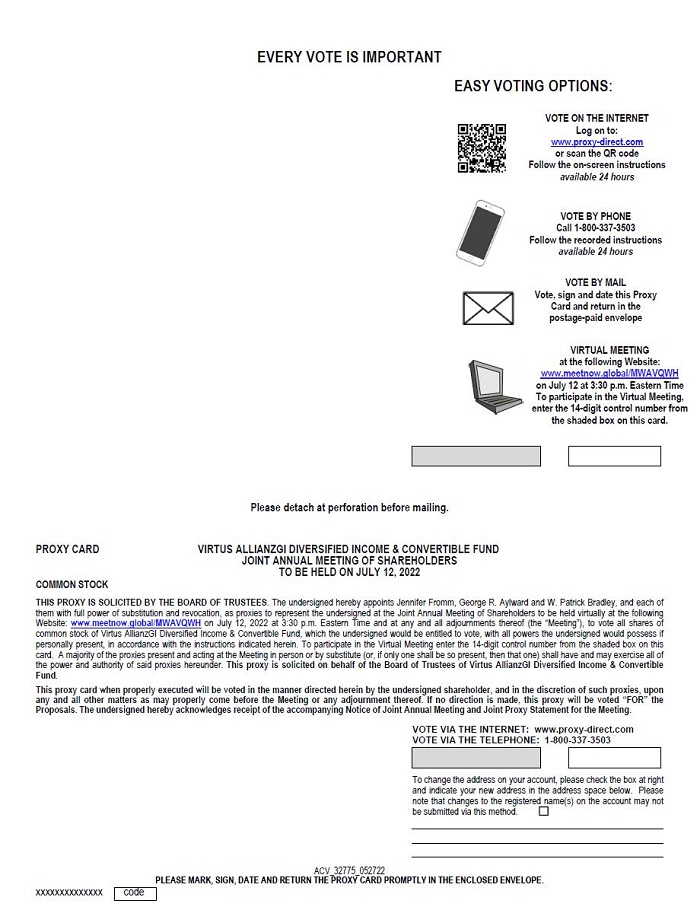

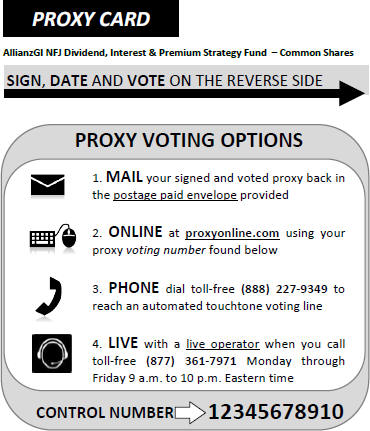

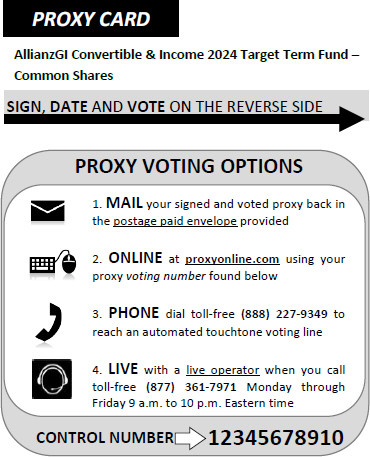

You may vote by mail by returning a properly executed proxy card, by Internet by going to the website listed on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person by attending the Meeting. Shares represented by duly executed and timely delivered proxies will be voted as instructed on the proxy. If you execute and mail the enclosed proxy and no choice is indicated for the election of Trustees listed in the attached Notice, your proxy will be voted in favor of the election of all nominees. At any time before it has been voted, your proxy may be revoked in one of the following ways: (i) by delivering a signed, written letter of revocation to the Secretary of the appropriate Fund at 1633 Broadway, New York, New York 10019, (ii) by properly executing and submitting a later-dated proxy vote, or (iii) by attending the Meeting and voting in person. Please call1-877-361-7971 for information on how to obtain directions to be able to attend the Meeting and vote in person. If any proposal, other than the Proposals set forth herein, properly comes before the Meeting, the persons named as proxies will vote in their sole discretion.

The principal executive offices of the Funds are located at 1633 Broadway, New York, New York 10019. AllianzGI U.S. serves as the investment manager of each Fund. Additional information regarding the Manager may be found under “Additional Information — Investment Manager” below.

NFJ Investment Group LLC (“NFJ Group”) merged with and into AllianzGI U.S. on July 1, 2017 (the “NFJ Consolidation”) by means of a statutory merger. Prior to the NFJ Consolidation, AllianzGI U.S. served as the investment manager for NFJ and delegated portfolio management of a portion of NFJ to the NFJ Group. AllianzGI U.S. remains the primary adviser to NFJ following the NFJ Consolidation, and, in addition to the advisory services it previously provided, it directly provides the portfolio management services that NFJ Group previously provided with respect to a portion of the assets of NFJ. The NFJ Consolidation did not result in any change to the manner in which investment advisory services are provided to NFJ, the personnel responsible for providing investment advisory services to NFJ or the personnel ultimately responsible for overseeing the provision of such services.

The solicitation will be primarily by mailProposals 1a through 1d, 1m through 1p and the cost of soliciting proxies for a Fund will be borne individually by each Fund. Certain officers of the Funds and certain officers and employees of the Manager or its affiliates (none of whom will receive additional compensation therefor) may solicit proxies by telephone, mail,e-mail and personal interviews. Anyout-of-pocket expenses incurred in connection with the solicitation will be borne by each Fund based on its relative net assets.

Unless a Fund receives contrary instructions, only one copy of this Proxy Statement will be mailed to a given address where two or more Shareholders share that address. Additional copies of the Proxy Statement will be delivered promptly upon request. Requests may be sent to the Secretary of the Fund c/o Allianz Global Investors U.S. LLC, 1633 Broadway, New York, New York 10019, or by calling1-877-361-7971 on any business day.

5

As of the Record Date, the Trustees, nominees and officers of each Fund,1u through 1bb, as a group and individually, beneficially owned less than one percent (1%) of each Fund’s outstanding Shares and, to the knowledge of the Funds, the following entities beneficially owned more than five percent (5%) of a class of NCV, NCZ, CBH, ACV, NIE or NFJ:

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

6

PROPOSAL: ELECTION OF TRUSTEES

In accordance with each of the Fund’s Amended and Restated Agreement and Declarations of Trust (each, a “Declaration”), the Trustees have been divided into the following three classes (each, a “Class”): Class I, Class II and Class III. Each Fund’s Governance and Nominating Committee has recommended the nominees listed herein forre-election as Trustees by the Shareholders of the Funds.

NCV. With respect to NCV, the term of office of the Class III Trustees will expire at the Meeting; the term of office of the Class I Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2019 through February 29, 2020); and the term of office of the Class II Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2020 through February 28, 2021). Currently, Deborah A. DeCotis, F. Ford Drummond, James S. MacLeod and A. Douglas Eu are Class III Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Ms. DeCotis and Messrs. Drummond, MacLeod and Eu forre-election by the Common and Preferred Shareholders, voting as a single class, as Class III Trustees and Mr. Holt for election by the Common and Preferred Shareholders, voting as a single class, as a Class I Trustee. Consistent with the Fund’s Declaration, ifre-elected, the nominees shall hold office for terms coinciding with the Classes of Trustees to which they have been designated. If elected, Mr. Holt shall hold office for terms coinciding with the Class of Trustees to which he has been designated. Therefore, ifre-elected at the Meeting, Ms. DeCotis and Messrs. Drummond, MacLeod, and Eu will serve terms consistent with the Class III Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2021 through February 28, 2022), and Mr. Holt will serve terms consistent with the Class I Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2019 through February 29, 2020).

NCZ. With respect to NCZ, the term of office of the Class III Trustees will expire at the Meeting; the term of office of the Class I Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2019 through February 29, 2020); and the term of office of the Class II Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2020 through February 28, 2021). Currently, F. Ford Drummond, Hans W. Kertess, James S. MacLeod and A. Douglas Eu are Class III Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Messrs. Drummond, Kertess, MacLeod and Eu forre-election by the Common and Preferred Shareholders, voting as a single class, as Class III Trustees and Mr. Holt for election by the Common and Preferred Shareholders, voting

7

as a single class, as a Class I Trustee. Consistent with the Fund’s Declaration, ifre-elected, the nominees shall hold office for terms coinciding with the Classes of Trustees to which they have been designated. If elected, Mr. Holt shall hold office for terms coinciding with the Class of Trustees to which he has been designated. Therefore, ifre-elected at the Meeting, Messrs. Drummond, Kertess, MacLeod and Eu will serve terms consistent with the Class III Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2021 through February 28, 2022), and Mr. Holt will serve terms consistent with the Class I Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2019 through February 29, 2020).

ACV. With respect to ACV, the term of office of the Class III Trustees will expire at the Meeting; the term of office of the Class I Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2019 through January 31, 2020); and the term of office of the Class II Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2020 through January 31, 2021). Currently, Deborah A. DeCotis and Bradford K. Gallagher are Class III Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Ms. DeCotis and Mr. Gallagher for election by the Common and Preferred Shareholders, voting as a single class, as Class III Trustees, and Mr. Holt for election by the Common and Preferred Shareholders, voting as a single class, as a Class III Trustee. Consistent with the Fund’s Declaration, the nominees shall hold office for terms coinciding with the Classes of Trustees to which they have been designated. Therefore, if elected at the Meeting, Ms. DeCotis and Messrs. Gallagher and Holt will serve terms consistent with the Class III Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2021 through January 31, 2022).

NIE. With respect to NIE, the term of office of the Class II Trustees will expire at the Meeting; the term of office of the Class III Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2019 through January 31, 2020); and the term of office of the Class I Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2020 through January 31, 2021). Currently, F. Ford Drummond, James A. Jacobson, James S. MacLeod and A. Douglas Eu are Class II Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Messrs. Drummond, Jacobson, MacLeod and Eu forre-election as Class II Trustees, and Erick R. Holt for election as a Class III Trustee. Consistent with the Fund’s Declaration, ifre-elected, the nominees shall hold

8

office for terms coinciding with the Classes of Trustees to which they have been designated. Therefore, ifre-elected at the Meeting, Messrs. Drummond, Jacobson, MacLeod and Eu will serve a term consistent with the Class II Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2021 through January 31, 2022), and Mr. Holt will serve terms consistent with the Class III Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2019 through January 31, 2020).

NFJ. With respect to NFJ, the term of office of the Class I Trustees will expire at the Meeting; the term of office of the Class II Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2019 through January 31, 2020); and the term of office of the Class III Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2020 through January 31, 2021). Currently, Hans W. Kertess, James S. MacLeod , William B. Ogden, IV and A. Douglas Eu are Class I Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Messrs. Kertess, MacLeod, Ogden and Eu forre-election as Class I Trustees, and Erick R. Holt for election as a Class II Trustee at the Meeting. Consistent with the Fund’s Declaration, ifre-elected, the nominees shall hold office for terms coinciding with the Classes of Trustees to which they have been designated. Therefore, ifre-elected at the Meeting, Messrs. Kertess, MacLeod, Ogden and Eu will serve terms consistent with the Class I Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2021 through January 31, 2022), and Mr. Holt will serve terms consistent with the Class II Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from February 1, 2019 through January 31, 2020).

CBH. With respect to CBH, the term of office of the Class I Trustees will expire at the Meeting; the term of office of the Class II Trustees will expire at the annual meeting of Shareholders for the 2019-2020 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2019 through February 29, 2020); and the term of office of the Class III Trustees will expire at the annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2020 through February 28, 2021). Currently, Hans W. Kertess, William B. Ogden, IV, Alan Rappaport and Davey S. Scoon are Class I Trustees. Upon the recommendation of the Governance and Nominating Committee, the Board is nominating Messrs. Kertess, Ogden, Rappaport and Scoon for election as Class I Trustees, and Erick R. Holt for election as a Class III Trustee. Consistent with the Fund’s Declaration, if elected, the nominees shall hold office for terms coinciding with the Classes of Trustees to which they have been designated. Therefore, if

9

re-elected at the Meeting, Messrs. Kertess, Ogden, Rappaport and Scoon will serve a term consistent with the Class I Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2021-2022 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2021 through February 28, 2022), and Mr. Holt will serve terms consistent with the Class III Trustees, which will expire at the Fund’s annual meeting of Shareholders for the 2020-2021 fiscal year (i.e., the annual meeting held during the fiscal year running from March 1, 2020 through February 28, 2021).

|

| |||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

10

|

| |||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

Under this classified Board structure, generally only those Trustees in a single Class may be replaced in any one year, and it would require a minimum of two years to change a majority of the Board under normal circumstances. This structure, which may be regarded as an “anti-takeover” provision, may make it more difficult for a Fund’s Shareholders to change the majority of Trustees of the Fund, and thus promotes the continuity of management.

applicable.

current Trustees and Officers

the Nominees is set forth in the tables that follow. The business of each Fund“Interested” Trustee is managed under the direction of the Fund’s Board of Trustees. Subject to the provisions of each Fund’s Declaration, its Bylaws and applicable state law, theindicated by an asterisk (*). Independent Trustees have all powers necessary and convenient to carry out this responsibility, including the election and removal of the Fund’s officers.

Board Leadership Structure— Assuming the nominees are elected as proposed, the Board of Trustees will consist of eleven Trustees, nine of whomthose who are not “interested persons” (within the meaning of(as defined in Section 2(a)(19) of the Investment Company Act of 1940 Act)(the “1940 Act”)) of (i) the applicable Fund, (ii) the Funds’ investment adviser (Virtus Investment Advisers, Inc., the “Adviser”) or applicable subadvisers (AllianzGI US and NFJ Investment Group, LLC (“NFJ Group”) and each a “Subadviser”), or (iii) a principal underwriter of any Fund, and who satisfy the Managerrequirements contained in the definition of “independent” as defined in the 1940 Act (the “Independent Trustees”), which would mean more than 81% of Board members are Independent Trustees. An Independent Trustee serves as Chair of the Board and is selected by a vote of the majority of the Independent Trustees. The Chair of the Board presides at meetings of the Board and acts as a liaison with service providers, officers, attorneys and other Trustees generally between meetings, and

11

.

performs such other functions as may be requested by the Board from time to time. Mr. Scoon has been selected by the Independent Trustees to serve as Chair of the Board. If elected by Shareholders of CBH at the Meeting, Mr. Scoon will continue to serve as the Chair of the Board of CBH. Mr. Kertess has been selected by the Independent Trustees to serve as Vice Chair of the Board. If

The Board of Trustees of each Fund meets regularly four times each year to discuss and consider matters concerning the Funds, and also holds special meetings to address matters arising between regular meetings. The Independent Trustees regularly meet outside the presence of management and are advised by independent legal counsel. Regular meetings generally take placein-person;AND ADVISORY BOARD MEMBER other meetings may take placein-person or by telephone.

The Board of Trustees has established six standing Committees to facilitate the Trustees’ oversight of the management of each Fund: the Audit Oversight Committee, the Compliance Committee, the Contracts Committee, the Governance and Nominating Committee, the Performance Committee and the Valuation Committee. The functions and role of each Committee are described below under “— Board Committees and Meetings.” The membership of each Committee includes, at a minimum, all of the current Independent Trustees, which the Board believes allows them to participate in the full range of the Board’s oversight duties.

The Board reviews its leadership structure periodically and has determined that this leadership structure, including an Independent Chair, a supermajority of Independent Trustees and having Independent Trustees serve as Committee Chairs, is appropriate in light of the characteristics and circumstances of each Fund. In reaching this conclusion, the Board considered, among other things, the predominant role of the Manager in theday-to-day management of Fund affairs, the extent to which the work of the Board is conducted through the Committees, the number of portfolios that comprise the Fund Complex (as defined in the instructions to Schedule 14A), the variety of asset classes those portfolios include, the net assets of each Fund and the Fund Complex and the management and other service arrangements of each Fund and the Fund Complex. The Board also believes that its structure, including the presence of two Trustees who are executives with one or more Manager-affiliated entities (which would continue to be the case for NCV, NCZ, NIE and NFJ, if Mr. Eu isre-elected and which would continue to be the case for all Funds, if Mr. Holt is elected), facilitates an efficient flow of information concerning the management of each Fund to the Independent Trustees.

Risk Oversight— Each of the Funds has retained the Manager to provide investment advisory services, and, in the case of the Manager, administrative services, and these service providers are immediately responsible for the management of risks that may arise from Fund investments and operations. Some employees of the Manager

12

and its affiliates serve as the Funds’ officers, including the Funds’ principal executive officer and principal financial and accounting officer, chief compliance officer and chief legal officer. The Manager employs different processes, procedures and controls to identify and manage different types of risks that may affect the Funds. The Board oversees the performance of these functions by the Manager both directly and through the Committee structure it has established, including the Compliance Committee. The Board, either directly or through its Compliance Committee, receives from the Manager a wide range of reports and presentations, both on a regular andas-needed basis, relating to the Funds’ activities and to the actual and potential risks of the Funds. These include, among others, reports and presentations on investment risks, custody and valuation of Fund assets, compliance with applicable laws, the Funds’ financial accounting and reporting and the Board’s oversight of risk management functions. In addition, the Performance Committee of the Board meets periodically with the individual portfolio managers of the Funds or their delegates to receive reports regarding the portfolio management of the Funds and their performance, including their investment risks. In the course of these meetings and discussions with the Manager, the Board has emphasized the importance of maintaining vigorous risk- management programs and procedures.

In addition, the Board has appointed a Chief Compliance Officer (“CCO”). The CCO oversees the development of compliance policies and procedures that are reasonably designed to minimize the risk of violations of the federal securities laws (“Compliance Policies”). The CCO reports directly to the Independent Trustees, interacts with individuals within the Manager’s organization, including its Head of Risk Management, and provides presentations to the Board at its quarterly meetings and an annual report on the application of the Compliance Policies. The Board periodically discusses relevant risks affecting the Funds with the CCO at these meetings. The Board has approved the Compliance Policies and reviews the CCO’s reports. Further, the Board annually reviews the sufficiency of the Compliance Policies, as well as the appointment and compensation of the CCO.

The Board recognizes that the reports it receives concerning risk management matters are, by their nature, typically summaries of the relevant information. Moreover, the Board recognizes that not all risks that may affect the Funds can be identified in advance; that it may not be practical or cost-effective to eliminate or mitigate certain risks; that it may be necessary to bear certain risks (such as investment-related risks) in seeking to achieve the Funds’ investment objectives; and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. As a result of the foregoing and for other reasons, the Board’s risk management oversight is subject to substantial limitations.

13

Information Regarding Trustees and Nominees.

The following table provides information concerning the Trustees/Nominees of the Funds.

Independent Trustees(1)

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | ||||||||||||

|

| Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years |

|

| ||||

Independent Trustees | | | | | | | | |||||||

| Cogan, Sarah E. YOB: 1956 Portfolios Overseen: 110 | | | Class III Trustee of AIO since 2019, nominee for term expiring 2025 Class II Trustee of NCV since 2019, term expires at the 2023 Annual Meeting Class I Trustee of NCZ since 2019, nominee for term expiring 2025(4) Class III Trustee of CBH since 2019, term expires at the 2023 Annual Meeting Class III Trustee of ACV since 2019, term expires at the 2024 Annual Meeting Class III Trustee of NIE since 2019, nominee for term expiring 2025 Class III Trustee of NFJ since 2019, term expires at the 2023 Annual Meeting | | | Retired Partner, Simpson Thacher & Bartlett LLP (“STB”) (law firm)(since 2019); Director, Girl Scouts of Greater New York (since 2016); Trustee, Natural Resources Defense Council, Inc. (since 2013); and formerly, Partner, STB (1989 to 2018). | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2019), PIMCO Closed-End Funds(5) (29 portfolios); Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, and Virtus Event Opportunities Trust (2 portfolios); Advisory Board Member (since 2021), Virtus Alternative Solutions Trust (2 portfolios), Virtus Mutual Fund Family (61 portfolios) and Virtus Variable Insurance Trust (8 portfolios); Advisory Board Member (February 2021 to June 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2019), Virtus AllianzGI Closed-End Funds (7 portfolios). | | ||||

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |||

| DeCotis, Deborah A.

YOB: 1952

Portfolios Overseen: 110 | | | Class III

Class III Trustee of NCV since 2011, term expires at the 2024 Annual Meeting Class II

Class III

Class III

Class III Trustee of NIE since 2011, nominee for term expiring 2025 Class II

| |

| | Advisory Director, Morgan Stanley & Co., Inc. (since 1996); Member, Circle Financial Group (since 2009); | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2011), PIMCO Closed-End Funds(5) (29 portfolios); Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, and Virtus Event Opportunities Trust (2 portfolios); Advisory Board Member (since 2021), Virtus Alternative Solutions Trust (2 portfolios), Virtus Mutual Fund Family (61 portfolios) and Virtus Variable Insurance Trust (8 portfolios); Advisory Board Member (February 2021 to June 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund; Trustee (since 2017), Virtus AllianzGI Convertible & Income 2024 Target Term Fund; Trustee (since 2015), Virtus AllianzGI Diversified Income & Convertible Fund; |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |||

| | | | | | | | | | Trustee (since 2014), Virtus Investment Trust (13 portfolios); Trustee (since 2011), Virtus Strategy Trust (11 portfolios); and Trustee (since 2011), Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Equity & Convertible Income Fund, and Virtus Dividend, Interest & Premium Strategy Fund. | | |||

Drummond, F. Ford

| | | Class II Trustee of AIO since 2019, term expires at the 2024 Annual Meeting Class III

Class III

Class II

Class II

Class II Trustee of NIE since 2015, term expires at the 2024 Annual Meeting | |

| | Owner/Operator (since 1998), Drummond Ranch; and Director (since 2015), Texas and Southwestern Cattle Raisers Association. Formerly, Chairman, Oklahoma Nature Conservancy (2019 to 2020); formerly Board Member (2006 to 2020) and Chairman (2016 to 2018), Oklahoma Water Resources | | | |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |

| | | | Class III Trustee of NFJ since 2015, term expires at the 2023 Annual Meeting | | | Plans (benefits administration). | | 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund; Trustee (since 2017), Virtus AllianzGI Convertible & Income 2024 Target Term Fund; Trustee (since 2015), Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Diversified Income & Convertible Fund, Virtus Dividend, Interest & Premium Strategy Fund and Virtus AllianzGI Equity & Convertible Income Fund; Trustee (since 2014), Virtus Strategy Trust (11 portfolios); Director (since 2011), Bancfirst Corporation; and Trustee (since 2006), Virtus Investment Trust (13 portfolios). | |||

| MacLeod, James S. YOB: 1947 Portfolios Overseen: 7 | | | |||||||||

Class II

Class III

Class III

| | | Chief Executive Officer (2010 to 2018), CoastalSouth Bancshares; President and Chief Operating Officer (2007 to 2018), Coastal States | | | Trustee |

| | |||

| Name, Year of Birth and of Portfolios in Funds Complex Overseen by Trustee(1)(2) | |

14

|

| Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years |

|

| ||||

| | | since 2015, term expires at the 2024 Annual Meeting Class II

Class II Trustee of ACV Class II Trustee of NIE

|

| ||||||||||

Class I

Trustee of NFJ

| | Bank; Managing Director and President (2007 to 2018), Homeowners Mortgage, a President (2007 to 2018), Homeowners Mortgage a subsidiary of Coastal States Bank. |

| | ||||||||||

|

| Non-Executive Chairman | ||||||||||||

15

| | ||||||||||

McLoughlin, Philip R. | | | Class II Trustee of AIO since 2021, term expires at the 2024 Annual Meeting Class I Trustee of NCV since 2022, nominee for term expiring 2025(4) Class I Trustee of NCZ since 2021, term expires at the 2022 Annual Meeting Class I Trustee of CBH since 2022, nominee for term expiring 2024 Class III Trustee of ACV since 2021, term expires at the 2024 Annual Meeting Class II Trustee of NIE since 2021, term expires at the 2024 Annual | | | Private investor since 2010. | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2021), Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2021), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus | |

| Name, Year of Birth and Number of Funds Complex Overseen by Trustee(1)(2) | |

| Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years |

|

| |||

| | | Meeting Class II Trustee of NFJ since 2021, nominee for term expiring 2025 | | | | | | AllianzGI Diversified Income & Convertible Fund, Virtus AllianzGI Equity & Convertible Income Fund and Virtus Dividend, Interest & Premium Strategy Fund; Trustee (since 2022) and Advisory Board Member (2021), Virtus AllianzGI Convertible & Income 2024 Target Term Fund and Virtus AllianzGI Convertible & Income Fund; Director and Chairman (since 2016), Virtus Total Return Fund Inc.; Director and Chairman (2016 to 2019), the former Virtus Total Return Fund Inc.; Director and Chairman (2014 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee and Chairman (since 2013), Virtus Alternative Solutions Trust (2 portfolios); Trustee and Chairman (since 2011), Virtus Global Multi-Sector Income Fund; Chairman and Trustee (since 2003), Virtus Variable Insurance Trust (8 portfolios); Director (since 1995), closed-end funds managed by Duff & Phelps Investment Management Co. (3 funds); Director (1991 to 2019) and Chairman (2010 to 2019), Lazard World Trust Fund | |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |||

| | | | | | | | | | (closed-end investment firm in Luxembourg); and Trustee (since 1989) and Chairman (since 2002), Virtus Mutual Fund Family (61 portfolios). | | |||

| Ogden, IV, William B.

YOB: 1945

Portfolios Overseen: 7 | | | Class I

Class I

Class I

Class I

Class I

Class I Trustee of NIE since 2007, term expires at the 2023 Annual Meeting Class I Trustee of NFJ since 2006, term expires at the 2024 Annual Meeting | |

| | Retired. Formerly, Asset Management Industry Consultant; and Managing Director, Investment Banking Division of Citigroup Global Markets Inc. | | Trustee (since 2006), Virtus AllianzGI Closed-End Funds (7 portfolios); Trustee, PIMCO Closed-End Funds(5) (29 portfolios). | ||||

| Rappaport, Alan YOB: 1953 Portfolios Overseen: 7 | | | |||||||||||

Class I

Class I

| |

| | | Trustee | | |||||||

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |

| | | | Class I Trustee of NCZ since 2010, nominee for term expiring 2025 Class I Trustee of CBH since 2017, term expires at the 2024 Annual Meeting Class I Trustee of ACV since 2015, nominee for term expiring 2025 Class I Trustee of NIE since 2010, term expires at the 2023 Annual Meeting Class III Trustee of NFJ since 2010, term expires at the 2023 Annual Meeting | | | Stern School of Business (2011 to 2020); Lecturer, Stanford University Graduate School of Business (2013 to 2020); Advisory Director (formerly, Vice Chairman), Roundtable Investment Partners (2009 to 2018); Member of Board of Overseers, NYU Langone Medical Center | | | |||

| Walton, R. Keith YOB: 1964 Portfolios Overseen: 110 | | | |||||||||

Class II

Trustee of ACV

| since 2022, nominee for term expiring 2023 Advisory Board Member of AIO, NCV, NCZ, CBH, NIE

| | Venture and Operating Partner (since | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee | ||||||

Interested Trustees(1)

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | ||||||||||||

|

| Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years |

|

| ||||

| | |

| | Senior Adviser (2018 to 2019), Plexo, LLC; and Partner (since 2006), Global Infrastructure Partners. Formerly, Managing Director (2013 to 2017), Arizona State University. | | ||||||||

|

| |||||||||||||

Securities Ownership

For each Trustee/Nominee, the following table discloses the dollar range of equity securities beneficially owned by the Trustee/Nominee in the Funds, and on an aggregate basis, as of the Record Date, in any registered investment companies overseen by the Trustee/Nominee within the “family of investment companies”

17

including the Funds. The dollar ranges used in the table are (i) None; (ii)$1-$10,000; (iii)$10,001-$50,000; (iv)$50,001-$100,000; and (v) Over $100,000. The following table includes securities in which the Trustees/ Nominees hold an economic interest through their deferred compensation plan. See “Trustees’ Compensation” below.

| ||||

| ||||

| ||||

| ||||

Virtus AllianzGI Diversified Income & Convertible Fund; Advisory Board Member (since 2022), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund, | ||||

| ||||

| ||||

| ||||

| ||||

Virtus AllianzGI Convertible & Income 2024 Target Term Fund, Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Equity & Convertible Income Fund | ||||

| | |||

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | |

| | | | | | | | | Fund Inc.; Trustee (since 2016), Virtus Global Multi-Sector Income Fund; Director (2006 to 2019), Systematica Investments Limited Funds; Director (2006 to 2017), BlueCrest Capital Management Funds; Trustee (2014 to 2017), AZ Service; Director (since 2004), Virtus Total Return Fund Inc.; and Director (2004 to 2019), the former Virtus Total Return Fund Inc. | |

| Zino, Brian T. YOB: 1952 Portfolios Overseen: 110 | | | Class I Trustee of AIO since 2022, nominee for term expiring 2023 Class III Trustee of NCV since 2022, nominee for term expiring 2024 Class I Trustee of NCZ since 2022, nominee for term expiring 2025 Class I Trustee of CBH since 2022, nominee for term expiring 2024 Class I Trustee of ACV since 2022, nominee for term expiring 2025(4) Class I Trustee of NIE since 2022, nominee for term expiring 2023 Class I Trustee of NFJ since 2022, nominee for term expiring 2024 | | | Retired. Various roles at J. & W. Seligman & Co. Incorporated (1982 to 2009) including President (1994 to 2009). | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2022) and Advisory Board Member (2021), Virtus AllianzGI Closed-End Funds (7 portfolios); Trustee (since 2020) Virtus Alternative Solutions Trust (2 portfolios), Virtus Variable Insurance Trust (8 portfolios) and Virtus Mutual Fund Family (61 | |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | ||||

| | | | | | | | | portfolios); Director (2016 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2016), Virtus Global Multi-Sector Income | ||||

| | | | | | | | | |||||

YOB: 1964 Portfolios Overseen: 115 | | | Class III Trustee of AIO since 2021, nominee for term expiring 2025 Class II Trustee of NCV since 2021, term expires at the 2023 Annual Meeting Class II Trustee of NCZ since 2021, term expires at the 2023 Annual Meeting Class III Trustee of CBH since 2021, term expires at the 2023 Annual | | Director, President and Chief Executive Officer (since 2008), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; various senior officer positions with Virtus affiliates (since 2005). | | | Trustee, President and Chief Executive Officer (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Member, Board of Governors of the Investment Company Institute (since 2021); Trustee and President (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event | |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | |

| | | Meeting Class II Trustee of ACV since 2021, term expires at the 2023 Annual Meeting Class III Trustee of NIE since 2021, nominee for term expiring 2025 Class II Trustee of NFJ since 2021, nominee for term expiring 2025 | | | | | | Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee, President and Chief Executive Officer (since 2021), Virtus AllianzGI | |

| Name, Year of Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) | | Term of Office and Length of Time Served(3) | | | Principal Occupation(s) During Past Five Years | | | Other Directorships/ Trusteeships Held by Trustee During the Past Five Years | | ||||

| | | | | | | | | Director, President and Chief Executive Officer (2006 to 2019), the former Virtus Total Return Fund Inc. | | |||

| | | | | | | | ||||||

YOB: 1964 Portfolios Overseen: 110 | | Advisory Board Member of AIO, NCV, NCZ, CBH, NIE and NFJ since 2022 | |||||||||||

| | | |||||||||||

| See above. | ||||||||||||

| |||||||||||||

| |||||||||||||

18

| ||||

| ||||

| ||||

| ||||

* Mr. Aylward is an “interested person” as |

To the knowledge of the Funds, as of the Record Date, Trustees and Nominees who are Independent Trustees or Independent Nominees and their immediate family members did not own securities of an investment adviser or principal underwriter of the Funds or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with an investment adviser or principal underwriter of the Funds.

Trustees’ Compensation

Each of the Independent Trustees and Nominees also serve as a trustee of Allianz Funds, AllianzGI Institutional Multi-Series Trust (“IMST”), Premier Multi-Series VIT (“VIT”) and Allianz Funds Multi-Strategy Trust (“MST”) (collectively with the Funds, the “Allianz-Sponsored Funds”). In addition, each of Messrs. Gallagher, Jacobson, Kertess, Ogden and Rappaport and Ms. DeCotis serves as a trustee or director of a number ofclosed-end andopen-end funds for which Allianz Global Investors Fund Management LLC (“AGIFM”) previously served as investment manager and its affiliate, Pacific Investment Management Company LLC (“PIMCO”), served assub-adviser (together, the “PIMCO-Sponsored Funds”). The PIMCO-Sponsored Funds were transitioned to the PIMCO Funds platform effective September 5, 2014, such that AGIFM no longer served as the investment manager to those funds. Since that time, the Independent Trustees have received separate compensation from the Allianz-Sponsored Funds in addition to amounts received for service on the Boards of the PIMCO-Sponsored Funds.

Each of VIT, IMST, MST, Allianz Funds and the Funds are expected to hold joint meetings of their Boards of Trustees whenever possible. Each Trustee, other than any Trustee who is a director, officer, partner or employee of the Manager or any entity controlling, controlled by or under common control with the Manager receives annual compensation of $235,000, payable quarterly. The Independent Chairman of the Boards receives an additional $75,000 per year, payable quarterly. The Audit Oversight Committee Chairman receives an additional $25,000 annually, payable quarterly. The Performance Committee Chair receives and additional $10,000 annually, payable quarterly. The Contracts Committee Chair receives an additional $10,000 annually, payable quarterly. The Valuation Committee Chair receives an additional $5,000 annually, payable quarterly. The Compliance Committee Chair receives an additional $5,000 annually, payable quarterly. Trustees are also reimbursed for meeting-related expenses.

Each Trustee’s compensation and other costs in connection with joint meetings are allocated among the Allianz-Sponsored Funds, as applicable, on the basis of fixed percentages as between each such group of funds. Trustee compensation and other costs are

19

then further allocated pro rata among the individual Funds based on the complexity of issues relating to each such Fund and relative time spent by the Trustees in addressing them, and on each such Fund’s relative net assets.

Trustees do not currently receive any pension or retirement benefits from the Funds or the Fund Complex. The Funds have adopted a deferred compensation plan for the Trustees that permits the Trustees to defer their receipt of compensation from the Funds, at their election, in accordance with the terms of the plan. Under the plan, each Trustee may elect not to receive fees from Funds on a current basis but to receive in a subsequent period chosen by the Trustee an amount equal to the value of such compensation if they had been invested in a fund in the Allianz Funds Complex selected by the Trustees on the normal payment dates for such compensation. As a result of this arrangement, the Funds, upon making the deferred payments, will be in substantially the same financial position as if the deferred compensation had been paid on the normal payment dates and immediately reinvested in shares of the fund(s) selected by the Trustees.

The following table provides information concerning the compensation paid to the Trustees/Nominees of the Funds who are not “interested persons” (as defined in the 1940 Act)Act, by reason of his position as President and Chief Executive Officer of Virtus, the ultimate parent company of the Adviser and NFJ Group, and various positions with its affiliates.